Configuring Pricing

Settings

Overview

of Pricing Settings

You can prevent taxes and shipping from displaying in the shopping cart

by clearing the checkboxes on the Pricing

Settings tab.

Pricing settings are applied across all price sheets in the system.

To

configure pricing settings

1. On the Price Sheet

Management page, open the Settings

tab.

2. From the Site Currency pull-down list, select

the currency standard to use for the site.

Note:

You cannot change the site

currency if credit card merchant accounts are enabled on your site. (You

can temporarily disable the merchant account, change the currency, then

reenable the merchant account, if needed.)

You can change the default currency used for displaying prices on the storefront

to any of the currencies supported on the site. Also, all data sent to

other systems (e.g., output devices, MIS, ESC, etc.) will refer to the

site currency when applicable.

1. Click the currency link in the footer of any page on the site.

Although you can change the

currency that is displayed on the storefront, any purchases you make on

the site are still charged in the site's currency.

2. In the Currency field,

select the currency you want to display on the storefront. The conversion

rate (relative to the default currency for the site) is updated based

on the currency you selected.

3. If

you want your buyers to see their orders in currencies other than the

site-level currency and you wish to manually maintain exchange rate data

for the other currencies, check

the Enable currency conversion box.

Note:

Enabling currency conversion will cause the Alternate

Currencies tab to be displayed. To configure alternate currencies

see Configuring

Alternate Currencies.

4. In most cases you will not need to use this field

because the MarketDirect StoreFront

database already knows how many decimal places your site currency requires.

If you have a currency denomination(s) that your country does not use,

you can supply a smallest currency unit that you want your buyers to see.

● For example:

The MarketDirect StoreFront

database knows that Australian dollars use 2 digits after the decimal

point; however, the Australians do not use the smallest unit (.01) as

a coin. Their smallest coin is 0.05. In this case, an Australian site

can check the Override default currency

rounding off feature box and then enter 0.05 as the smallest unit

in the Site Currency Rounding Off value

field.

● Another

example: In the U.S., the lowest denomination of the U.S. dollar is one

cent ($1/100 or $.01), whereas in Switzerland, the lowest denomination

of the Swiss franc is five rappen/five centimes (.05 CHF or S.fr.). To

accommodate buyers making purchases with Swiss franc currency, you would

set the rounding value to .05 since the currency does not have a .01 denomination.

Warning:

The Override default currency rounding

off feature box should not be checked for the overwhelming majority

of currencies (e.g., U.S. Dollar, the Euro, the Japanese Yen).

The Site Currency Rounding Off value

field should not be used to have MarketDirect StoreFront

display more decimal digits than it normally would. If you want to display

more decimal digits, please contact EFI MarketDirect StoreFront

technical support.

5. If

you are using the Sales Tax taxation model:

● Perform

Tax Calculations: Check if you want taxes to be shown in the shopping

cart or clear the box to prevent taxes from displaying in the shopping

cart.

● Perform

Shipping Calculations: Check if you want shipping charges to be

calculated or clear the box to omit them.

● Charge

Taxes for Shipping: Check if you want tax charges to apply to shipping

as well as the product order total.

Note:

Charge taxes for shipping

will be active only if Perform

Tax Calculations and

Perform Shipping Calculations

options are both checked.

● Charge

Taxes for Handling: Check if you want tax charges to apply to handling

as well as the product order total.

OR

If you are using VAT taxation model:

● Perform

VAT Calculations: Check if you want

VAT amounts to be shown in the shopping cart or clear the box to prevent

VAT amounts from displaying in the shopping cart.

● Perform

Shipping Calculation: Check if you

want shipping charges to be calculated or clear the box to omit them.

● Charge

VAT For Shipping: Specify the VAT definition

to use for shipping charges.

Note:

Applies only if both VAT and shipping calculations are performed.

● Charge

VAT for Handling: Specify the VAT definition to use for handling

charges.

● Charge

VAT for Postage on Direct Mail jobs: Specify

the VAT definition to use for direct mail jobs.

● Charge

VAT for Mailing List on Direct Mail jobs: Specify

the VAT definition to use for mailing lists on direct mail jobs.

● Charge

VAT for Digital Downloads: Specify the VAT definition to use for

digital download products.

6. Select Show

Unit Prices if you want unit prices to be shown to buyers on the

storefront during the ordering process.

Note: You

can override this setting at the company level on the Manage Company page.

7. Click Save.

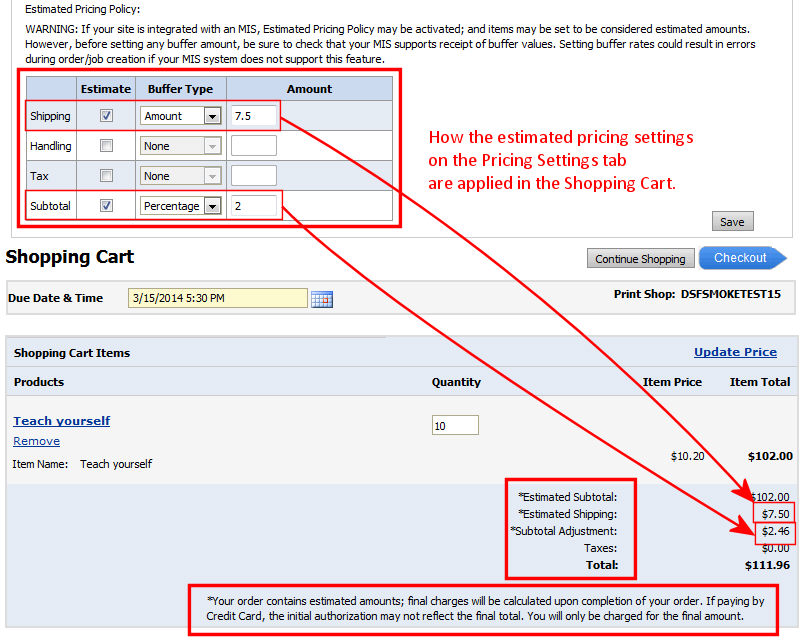

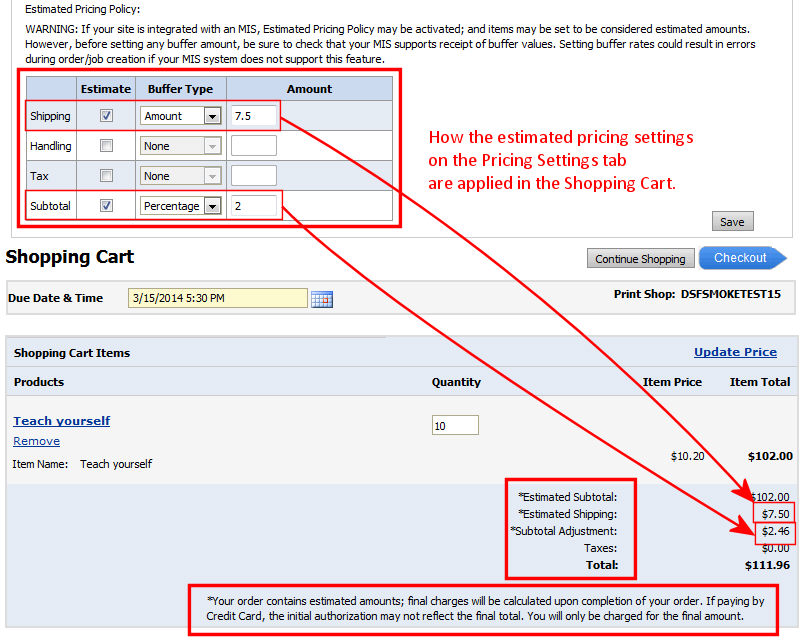

Configuring

Estimated Pricing Policy for the Entire Site - Site Level Pricing Estimation

Policy

In some cases, MarketDirect StoreFront

is not able to calculate the actual tax and shipping charges for an order.

Thus, the order prices in the shopping cart are estimated rather than

actual. Configuring an estimated pricing policy will help you manage how

this "subject to change" information is communicated to buyers

in the shopping cart to prevent unexpected discrepancies between the estimated

price quoted in the shopping cart and the actual price charged to the

buyer's account when enough data is available to render actual amounts.

You can communicate estimated pricing for the following types of charges:

● Shipping

● Handling

● Tax

● Subtotal

You can set your estimated pricing policy at the site

level (the policy settings will apply to all orders placed through

all Print Shops and companies

on your site), at the Print Shop

level (settings will apply to all orders placed through a particular

Print Shop), or at the company level (settings will apply

to all orders placed through a particular company). This section covers

how to set an estimated pricing policy at the site level.

● For information

on setting an estimated pricing policy for a Print Shop,

see Estimated

Pricing Policy - Print Shop

Level.

● For information

on setting an estimated pricing policy for a company, see Estimated

Pricing Policy - Company Level.

Note:

If you do not want to communicate that prices for any of the order elements

(shipping, handling, tax, subtotal) are estimated rather than actual,

you do not need to do anything. By default, MarketDirect StoreFront

does not communicate to buyers that amounts are estimated rather than

actual. If you want to override this default and communicate that prices

in the shopping cart are estimated rather than actual follow the steps

below.

Note that the estimated values are labeled "Estimated" and prefixed

with an asterisk that directs buyers to a message stating that the final

charges will be calculated when the order is completed: "Your order

contains estimated amounts; final charges will be calculated upon completion

of your order. If paying by Credit Card, the initial authorization may

not reflect the final total. You will only be charged for the final amount."

The buffer applied to the subtotal will have the label "Subtotal

Adjustment." Please note that the message and labels are customizable

using MarketDirect StoreFront's

Language Management string customization tools (for more information see

the topic Language

Management - Customize Strings).

Note:

Note that the estimated pricing policy settings place at the time an order

is placed will be retained even if the estimated pricing policy settings

are changed after the order is placed (i.e., the buffered amounts will

be retained for a specific order as they were calculated at order placement).

To

configure estimated pricing policy for order shipping, handling, tax,

and subtotal at the Site Level

1. Go

to Administration > Pricing.

2. On the Price Sheet

Management page, open the Settings

tab.

3. In the Estimated

Pricing Policy section, check the Estimate

box for each order element whose price you want to designate as estimated.

● Shipping:

This is the shipping charge for delivering the order.

● Handling:

This the handling charge you assess

for the order (picking, packing, packing materials).

● Tax: This is the tax assessed on the order.

● Subtotal:

The price of the order before shipping, handling, and tax charges are

added.

.

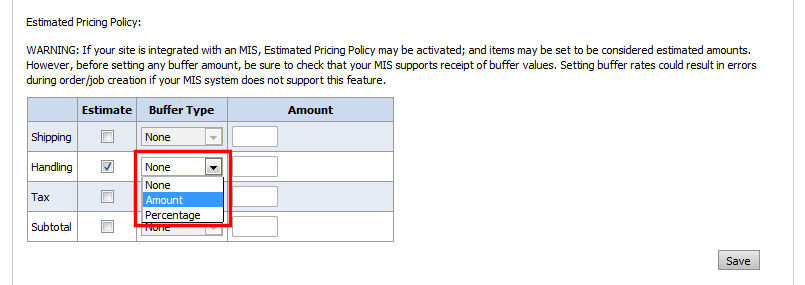

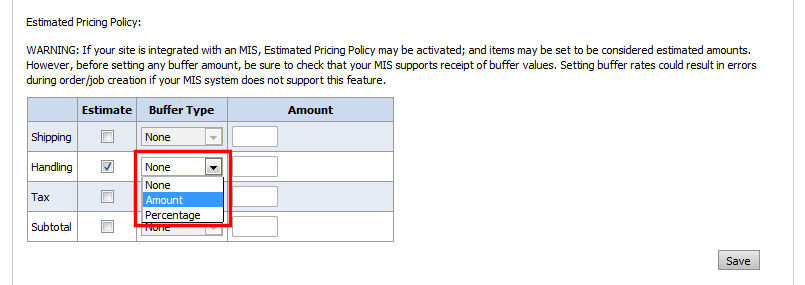

4. After you select

an element, the Buffer Type pull-down

list becomes active. Specify the buffer type:

Note:

The buffer is the amount added in the shopping cart to allow for some

discrepancy between the quoted price and the actual price. You can set

a buffer as a fixed amount or a percentage. If you apply a percentage,

for anything, that amount is calculated before any other buffers are applied.

For instance, the percentage is applied to the calculated total amount

(not the estimated price). For example, if Shipping has a fixed amount

buffer of $5, Handling has a % amount buffer of 10. The order is for $100

of product with a $10 shipping amount and a $2 handling amount. After

the buffers are applied, Subtotal = $100, Shipping = $15, and Handling

= $13 (as in (2 + (($100 + 10) * .1)) = (2 + (110 * .1)) = (2 + 11) =

13).

● None:

Select this option to have the calculated

amount for the element considered as estimated (and communicated to buyers

via a message).

Note:

For sites integrated with an MIS: If you want to use the estimated pricing

feature, make sure that your MIS supports receiving buffer values. If

it does not, you can use estimated pricing (e.g., to designate a bucket

such as shipping, handling, etc.) as estimated, not actual, but leave

the Buffer Type option set to None so you cannot enter an amount. The

message will still be displayed in checkout in this case, but no additional

buffer amounts will be added to the order.

● Amount:

Select this option to have the estimated

price of the element increased by a fixed amount that you specify in the

Amount field as a "buffer."

● For example, if you select the

Amount Buffer Type and specify an

Amount of 5.00, a fixed amount of $5.00

(or 5 units in the selected currency) will be added to the estimated order

total in the shopping cart.

● Percentage:

Select this option to have the estimated price of the element increased

by a percentage that you specify in the Amount

field as a "buffer."

● For example, if

you select the Percentage Buffer

Type and specify an Amount of

5, a percentage amount of 5% will be added to the estimated order total.

5. After you select

an Amount or Percentage buffer type, specify an amount in the Amount

field as a numeric (decimal) value such as 5, 5.0, or 5.5.

6. Choose

whether to charge taxes for Direct Mail jobs and Digital Download products:

● Charge

Taxes for Postage on Direct Mail jobs: Select the appropriate

tax authority from the pull-down list to apply.

● Charge

Taxes for Mailing List on Direct Mail jobs: Select the appropriate

tax authority from the pull-down list to apply.

● Charge

Taxes for Digital Downloads: Select the appropriate tax authority

from the pull-down list to apply.

7. Select a rounding

mode from the Midpoint Rounding Mode

pull-down list:

Note:

This will apply only to orders placed subsequent to the introduction of

this field in MarketDirect StoreFront

v. 7.4U1 and not to orders placed previously.

● Toward

nearest number away from zero: This

option will cause a number halfway between two others to be rounded to

the nearest number away from zero (this rounds "up"). For example:

This option would cause the value 2.025 to be rounded to 2.03.

● Toward

nearest even number: This option

will cause a number halfway between

two other to be rounded to the nearest even number (this could round "up"

or "down"). For example: This would cause the value 2.025 to

be rounded to 2.02 but the value 2.035 to be rounded to 2.04).

8. Click Save.

Configuring

Alternate Currencies

Alternate currencies include all MarketDirect StoreFront-supported

currencies other than the standard site currency that you want to support

for buyer purchases on your site.

To

configure alternate currencies

1. Go

to Administration > Pricing.

2. On the Price Sheet

Management page, open the Alternate Currencies

tab.

3. In the Active

column of the alternate currencies grid, select the currencies you want

to support for buyer purchases. These will be currencies that a buyer

may select to see on the web site and that you, the administrator, agree

to regularly maintain by updating the currency conversion rate.

4. In the Currency

Conversion column, type a conversion rate for the selected currency

with reference to the standard site currency.

For example, if your standard site currency is U.S. dollars ($) and you

are configuring the alternate currency Swiss francs (SFR), then you would

enter the current conversion rate as a percentage against the base rate.

Note:

Currency conversion in MarketDirect StoreFront is not

a real-time operation and must be configured manually on this tab. The

purpose of this manual currency conversion was to allow administrators

to change the rates when necessary or desired (as per the end of a period

or month) as opposed to serving as a real-time currency exchange rate

calculator that would change constantly. Note also that all sales are

calculated in the base rate, which is important for credit card transactions.

5. In the Currency

Rounding Off column, type the rounding value to apply to the selected

currency.

● For example:

The MarketDirect StoreFront

database knows that Australian dollars use 2 digits after the decimal

point; however, the Australians do not use the smallest unit (.01) as

a coin. Their smallest coin is 0.05. In this case, an Australian site

can check the Override default currency

rounding off feature box and then enter 0.05 as the smallest unit

in the Site Currency Rounding Off value

field.

● Another

example: In the U.S., the lowest denomination of the U.S. dollar is one

cent ($1/100 or $.01), whereas in Switzerland, the lowest denomination

of the Swiss franc is five rappen/five centimes (.05 CHF or S.fr.). To

accommodate buyers making purchases with Swiss franc currency, you would

set the rounding value to .05 since the currency does not have a .01 denomination.

Warning:

The Override default currency rounding

off feature box should not be checked for the overwhelming majority

of currencies (e.g., U.S. dollar, the Euro, the Japanese Yen).

The Site Currency Rounding Off value

field should not be used to have MarketDirect StoreFront

display more decimal digits than it normally would. If you want to display

more decimal digits, please contact EFI MarketDirect StoreFront

technical support.

6. Click Save.

Note:

Once you have activated the alternate currencies on this tab, you can

specify which currencies to support for each company and department.

For information on

specifying supported alternate currencies at the company level, see Companies.

For information

on specifying supported alternate currencies at the department level,

see Departments.

See Also

● Create

a Price Sheet

● Edit

a Price Sheet

● Publish

a Price Sheet

● Overview

of the Price Sheet Management Page

● Configure

Pricing Settings

● Billing

and Range Units

● How

to Use Special Pricing for a Company or Print Shop

● Adjust

Prices Using the Quote Editor

● Overview

of Pricing

● Contents

of the Pricing Help Module